Decarbonization of the transport sector and interest in regionalization are propelling Southeast Asia (SEA) into a lithium-ion battery (LIB) boom. Demand will grow exponentially as governments rally behind electric vehicle (EV) adoption and renewable energy. Both emerging and legacy players are expected to participate as industry attractiveness increases. Legacy LIB OEMs will be able to cater to traditional automotive OEMs as they transition to manufacturing EVs; however, emerging LIB OEMs must find their own cluster and niche while remaining cost competitive. This Viewpoint shares the importance of volume expansion and provides strategies that emerging LIB OEMs can use to help them compete in SEA’s LIB market.

A GROWING WAVE OF DEMAND

The LIB industry provides electrification to the transport sector to support decarbonization goals. The demand for LIBs will only continue to increase as countries transition toward electric mobility and seek more efficient energy storage systems (ESS) and options for renewable energy (RE) storage.

By 2030, the global demand for LIBs is projected to reach 3,100 GWh; SEA’s demand is estimated between 26 GWh and 30 GWh. Regulatory policies prioritizing EV adoption, paired with consumer preferences shifting toward sustainable transportation, have created strong growth potential in SEA’s LIB industry.

A growing preference for regionalized LIB supply is beginning to dominate the market. As a result, new LIB OEMs have emerged, hoping to gain traction in the rapidly expanding industry. Governments in SEA have been setting specific targets for EV penetration, which include financial incentives to speed up EV adoption.

In this Viewpoint, we explore the SEA LIB industry, including the dominance of the technology, sustainability-driven regulatory policies, the move toward regionalization, and the criticality of volume for LIB OEMs. We present achievable go-to-market strategies for local LIB OEMs to stay competitive against legacy LIB OEMs in addition to providing key recommendations for emerging LIB OEMs to achieve the necessary volume offtake.

MARKET ATTRACTIVENESS & KEY INSIGHTS

SEA stands out as a highly attractive market, driven by surging demand for LIBs. The demand can be attributed to regulatory policies prioritizing EV adoption, evolving consumer preferences, and regionalization of LIB supply. Thanks to these headwinds, both legacy and emerging LIB OEMs are looking at SEA and the opportunities that exist in the region. Both legacy LIB OEMs like CATL, BYD, and Samsung and emerging OEMs like Durapower, 24M (GPSC), Amita, and VinES have announced plans to build gigafactories in SEA. Emerging LIB players in particular need to formulate and adopt a well-guided strategy to secure a competitive edge, due to the convergence of compelling market attractiveness and intensifying competition for limited market demand.

The following sections will delve into essential facets of the SEA LIB industry and shed light on some of its important elements.

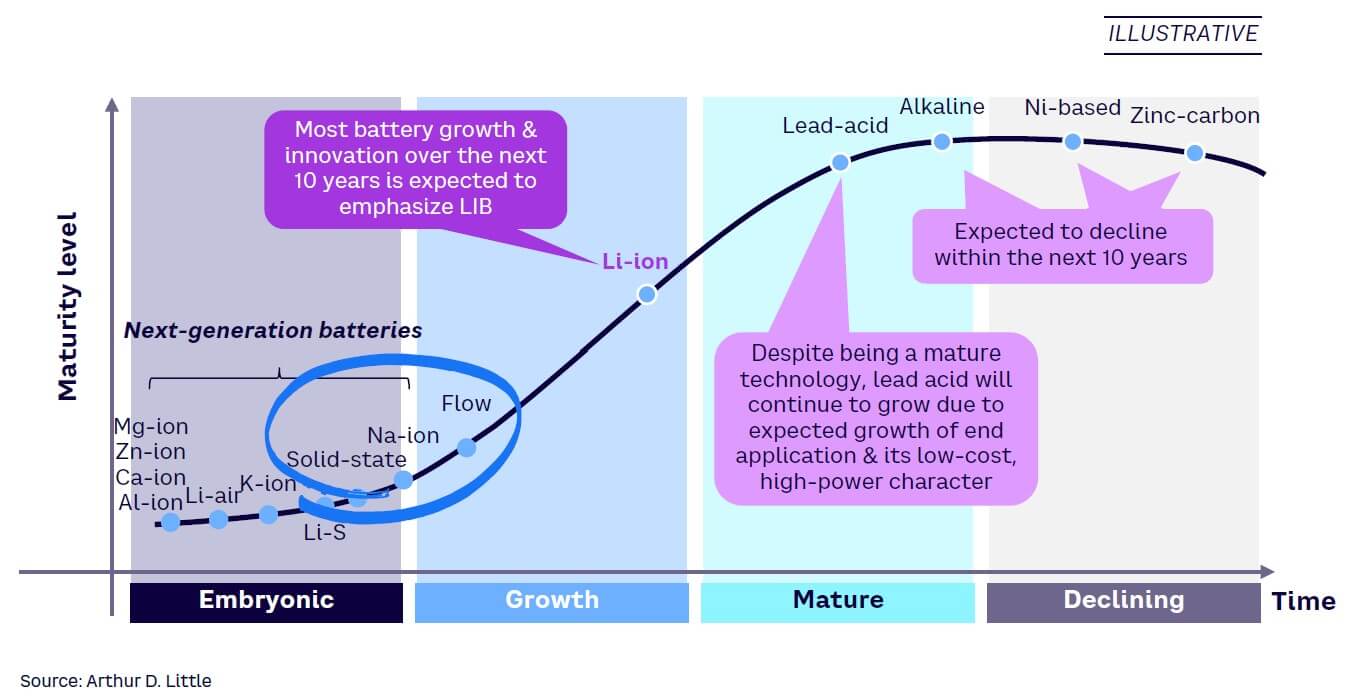

LIB: The dominant battery technology

Limitations and commercialization challenges hinder widespread adoption of alternative battery technologies. Solid-state batteries hold promise thanks to higher energy density, longer lifespan, and enhanced safety features, but commercial-scale production is still in its early stages, waiting for technological and manufacturing obstacles to be cleared. Sodium-ion (Na-ion) batteries are made from abundant raw materials and have potential cost advantages, but their lower energy density hinders widespread adoption. Flow batteries, with their scalability and extended cycle life, are also in development but face challenges related to cost-efficiency. These limitations make it evident that LIB will continue to dominate the industry, thanks to its established technology, performance capabilities, and continuous advancements.

Figure 1 highlights the continued prominence of LIB over the next 10 years, beyond which newer technologies will come into play. Hence, robust R&D into newer battery technologies should be prioritized by both emerging and legacy LIB OEMs. A strategic approach will ensure long-term relevance, sustainability, and competitiveness in the SEA and global LIB markets.

Regulatory policies mandate decarbonization

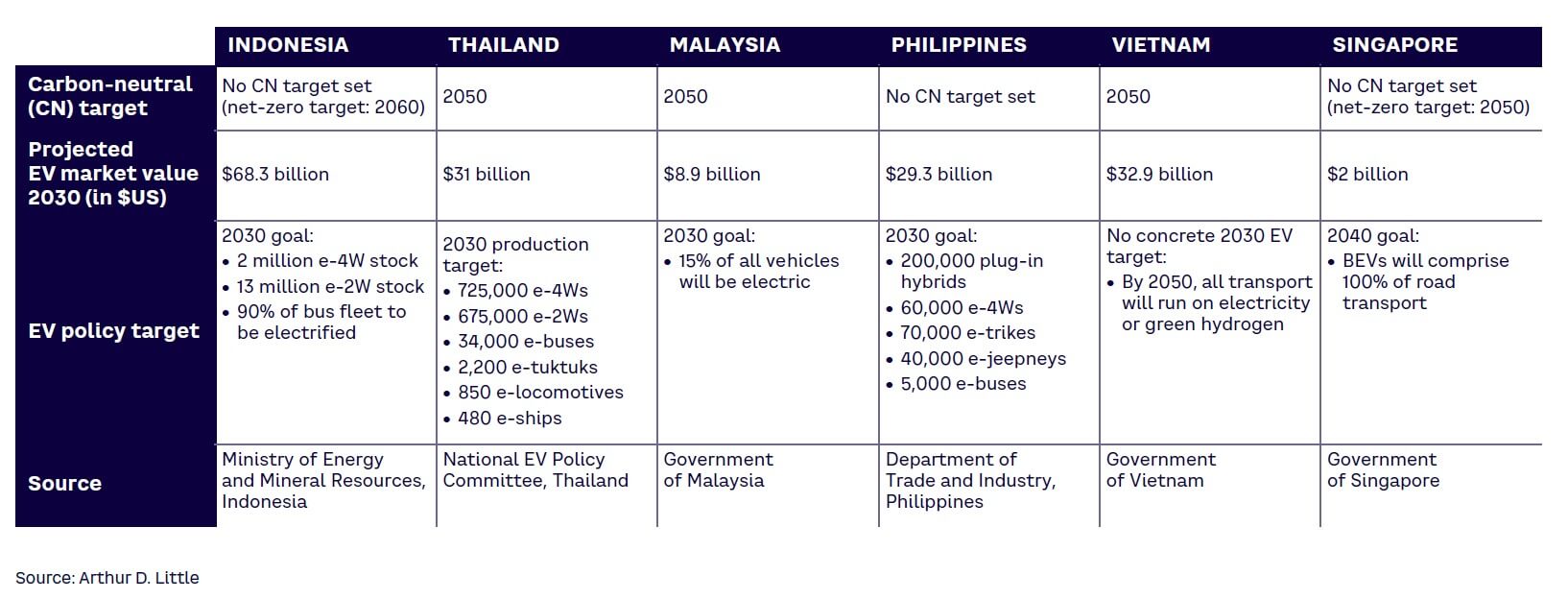

The transportation sector is a major contributor to global greenhouse gas (GHG) emissions, and governments in the SEA region are increasingly prioritizing decarbonization of this sector. Figure 2 shows how SEA countries are demonstrating a strong resolve to electrify their transport sector and achieve their declared carbon-neutrality targets. By aligning their regulatory policies to support firm EV adoption targets, these countries are directly creating an environment conducive to LIB adoption.

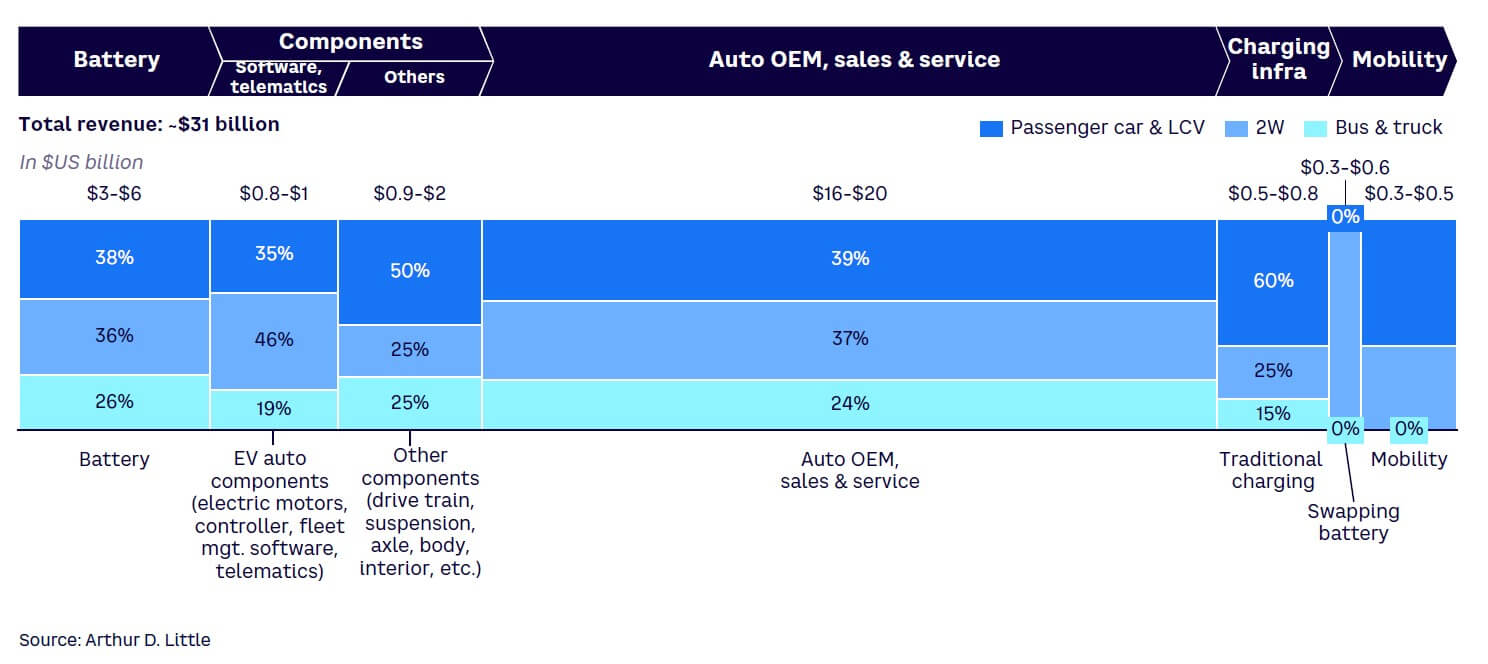

The announced EV targets have led to the creation of an entire EV ecosystem, ranging from upstream raw material supply, to midstream battery and component production, to downstream EV sales, after-sales, and charging infrastructure services. Figure 2 also highlights the substantial market size (US $2-$68 billion) in SEA across different countries and assumes government EV targets are met. In Thailand, for example, there exists a $3-$6 billion opportunity specifically for LIB players within the $31 billion market (see Figure 3).

Driving regionalization

Regionalization has become a compelling business trend in SEA. Governments have recognized the battery industry’s immense potential for job creation and future growth. This strategic shift involves establishing domestic production facilities and developing local raw materials, which decrease risk to the supply chain. Indonesia and Thailand are two examples of countries in the region that have policies in place to encourage regionalization. Indonesia offers government-sponsored subsidies and requires EVs to meet local content regulations to qualify. In Thailand, a proposed subsidy of THB ฿24 billion (US $700 million) encourages local battery production and imposes a tariff on imported cells. Arthur D. Little (ADL) analysis has revealed some of the key drivers behind the increasing dominance of regionalization:

-

Regionalization plays a crucial role in lowering the overall cost of EV adoption. Given that batteries constitute a substantial portion (30%-40%) of an EV’s value, localizing battery production enables economies of scale and cost-efficiencies. This, in turn, potentially reduces prices by 10%-20% and translates to more affordable EVs, which accelerates consumer uptake of electric mobility. Lowering the financial barrier to entry is instrumental to expediting the transition to cleaner transportation alternatives and supporting a faster rate of EV adoption across SEA.

-

Regionalization fuels economic development and local job creation. Establishing new battery factories leads to a direct employment boost, generating approximately 80 jobs for every one GWh. Additionally, these ventures have ripple effects throughout the local ecosystem, creating numerous indirect job opportunities in sectors such as raw material supply, construction, and ancillary services.

-

Regionalization addresses the critical aspect of supply chain control. Recent global shocks, including the COVID-19 pandemic and the Russia-Ukraine war, have exposed vulnerabilities in global supply chains, leading to sudden price spikes in raw materials and disruptive bottlenecks. SEA nations are actively embracing regionalization as a strategic response to mitigate such risks.

-

Regionalization endeavors to de-risk from sole reliance on China. According to Bloomberg, China dominates approximately 80% of the LIB raw material supply chain. Escalating geopolitical tensions and evolving trade dynamics have prompted SEA countries to diversify their sources and reduce vulnerability to geopolitical uncertainties.

-

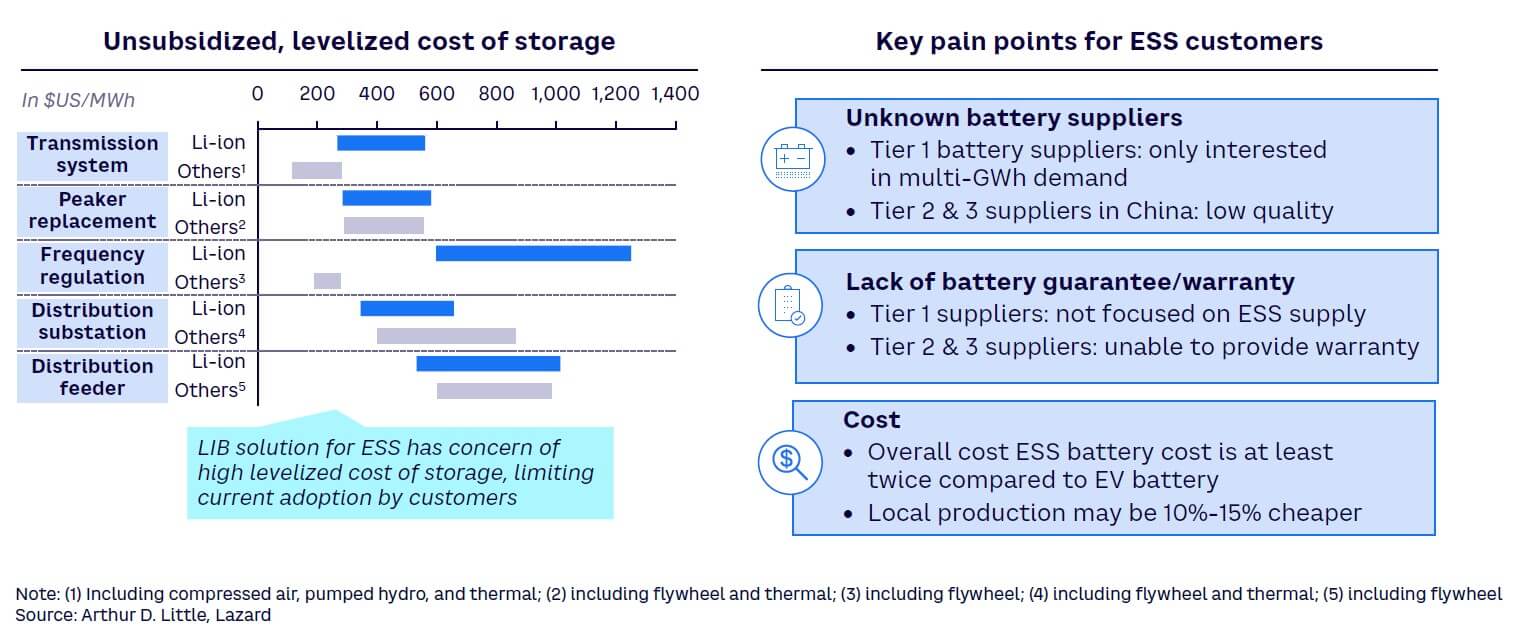

Regionalization unlocks LIB use case for ESS. The growing emphasis on RE has increased the demand for battery-based ESS. Regionalization emerges as a key strategy to overcome barriers hindering widespread adoption (see Figure 4). By localizing battery production, costs can be reduced by 10%-15%, making ESS financially viable. Additionally, regionalization addresses quality concerns in the ESS market, where low-quality and warranty-free batteries prevail due to limited focus from legacy LIB OEMs.

A PREFERENCE FOR LEGACY LIB OEMs

According to the International Energy Agency, the transportation sector accounted for nearly 37% of global C02 emissions from end-use sectors in 2021; passenger vehicles were the largest contributor. Countries worldwide have recognized the pressing need to promote EV adoption as a crucial step toward reducing GHG emissions and combating climate change. Governments in the SEA region have taken decisive action by setting specific EV penetration targets and implementing financial subsidies and tax exemptions to incentivize widespread EV adoption. As the region gears up for a significant transformation of its transportation landscape, it is crucial to understand market dynamics and potential challenges for emerging LIB OEMs seeking to carve their niche in the region.

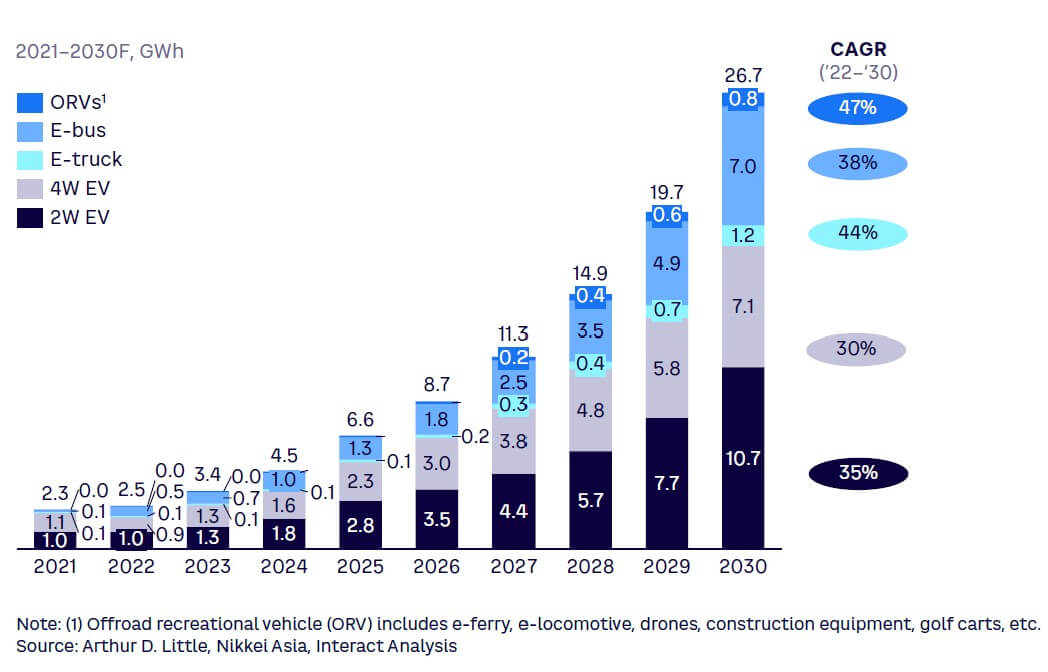

By 2030, 26.7 GWh of LIBs are projected to be consumed by mobility applications, which will account for 94% of the region’s overall battery demand (see Figure 5). Specifically, electric two-wheelers (e-2ws) and electric four-wheelers (e-4Ws) are expected to play a significant role, with 18 GWh dedicated to these applications.

A clear market trend has emerged in the e-4W segment as traditional automotive OEMs are choosing legacy LIB OEMs as strategic partners. This preference is rooted in the desire of automotive OEMs to capitalize on LIB OEMs’ established expertise, robust infrastructure, and economies of scale. Collaborating with these industry leaders enables traditional automotive OEMs to access cutting-edge battery technology, which ensures safe and reliable batteries with minimal risk. These partnerships also guarantee scalable and efficient supply chains tailored to the automotive OEMs’ requirements, along with the added advantage of leveraging the trusted branding and marketing prowess of renowned LIB suppliers. Furthermore, the ongoing R&D efforts of these partnerships accelerate the development and deployment of e-4W. Partnerships between LG Chemical and Panasonic with Tesla, Samsung with Volkswagen, and SK Innovation with Ford, Hyundai, and Kia illustrate the trend.

In the e-2W segment, the prevailing market trend differs from the e-4W segment, primarily driven by the dominant presence of e-2W start-ups in this sector. These agile start-ups prioritize customized LIBs that are cost-effective and available in smaller order lots. E-2W start-ups serve different target customer segments and do not need the branding that partnerships with legacy LIB OEMs require. These conditions open doors for emerging LIB OEMs to cater specifically to these start-ups by providing tailored solutions.

However, as traditional 2W OEMs like Honda, Yamaha, and Kawasaki enter the e-2W manufacturing space, the market dynamics may shift back toward a customer preference for legacy LIB OEMs. This preference significantly narrows down the potential market scope for emerging LIB OEMs. Hence, emerging LIB OEMs must carefully analyze existing industry norms, understand market dynamics, and identify strategic opportunities in order to gain and retain market share and ensure sufficient volume from these major LIB applications.

THE CRITICALITY OF VOLUME

Ensuring a substantial volume of demand is a key driver of success for LIB OEMs. As the demand for LIBs continues to surge, emerging LIB OEMs face a critical challenge: securing a committed volume of demand. This pivotal factor plays a decisive role in unlocking the benefits of scale and operational efficiency in the manufacturing process. LIB OEMs can create a demand pipeline by winning contracts in the free market through a tender process or entering into exclusive joint-venture agreements with automotive OEMs to guarantee captive demand.

Higher volume reduces COGS

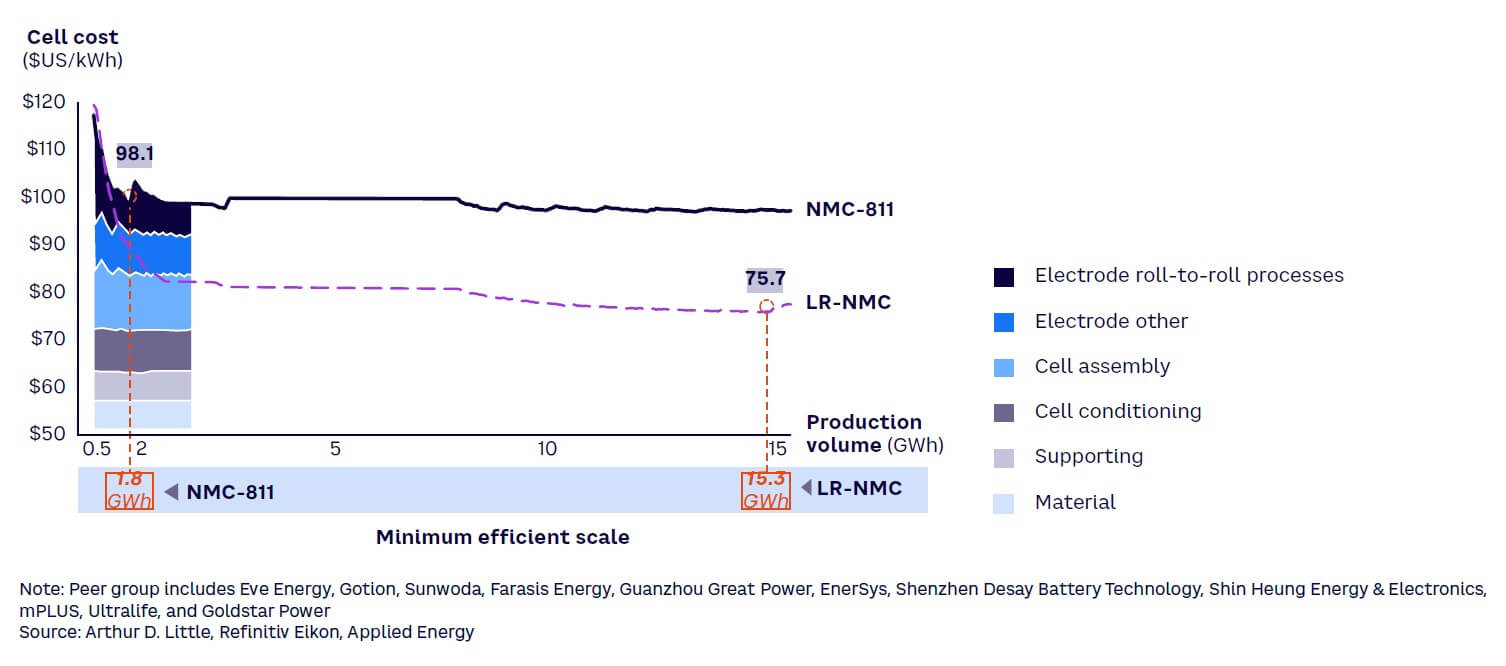

In LIB manufacturing, cost of goods sold (COGS) constitutes a critical component within the overall cost structure. ADL’s analysis of the cost structure of 14 prominent LIB OEMs, including industry leaders such as CATL, EVE Energy, and Gotion, reveals that COGS represents approximately 81.3% of revenue. Notably, COGS primarily comprises raw materials, and their cost is heavily influenced by volume. As such, if emerging LIB OEMs can secure high volume, they will be able to unlock bulk discounts from raw material suppliers that can significantly reduce their production costs. As shown in Figure 6, our analysis reveals a positive correlation between increased volume and decreasing cost. By capitalizing on the power of volume, these emerging LIB OEMs can gain a competitive edge and drive cost-efficiencies, paving the way to compete with legacy LIB OEMs on price.

Increased volume optimizes plant utilization

In manufacturing, volume plays a crucial role in achieving optimal plant utilization, particularly in LIB cell production. The point of minimum efficient scale is vital for process optimization and stability in this sector. LIB manufacturing follows an iterative process where the output from one process forms the input for another. Hence, machines must operate at an optimal level to ensure consistent utilization and efficiency. LIB manufacturers can reach the minimum efficient scale by increasing volume, which minimizes underutilization and pauses in the production cycle. This results in improved process optimization, stability, and overall productivity, ensuring that LIB manufacturing meets the demands of the market while maintaining high standards of quality and efficiency.

Assured volume gets preferential pricing from suppliers

The LIB industry’s raw material supply chain demonstrates significant concentration, with a select group of key manufacturers holding a majority of the market share. For example, in the cathode industry, renowned global suppliers including Umicore, Sumitomo Metal Mining, Nichia, Xiamen Tungsten, and Ningbo Shanshan collectively dominate with a market share of approximately 40%.

According to BloombergNEF, raw materials constitute approximately three-quarters of the total LIB cost, making long-term strategic supply agreements crucial. These agreements play a vital role in securing a steady supply of raw materials and obtaining preferential pricing. By proactively addressing raw material challenges and forging strong supply partnerships, emerging LIB OEMs can establish cost competitiveness and reliability, helping them meet the evolving demands of end-use customers.

HOW EMERGING LIB OEMs CAN COMPETE

Navigating the competitive landscape of the LIB marketplace requires strategic agility from emerging LIB OEMs. Legacy LIB OEMs benefit from assured demand from e-4W applications and obtain more competitive pricing. However, emerging LIB OEMs must adopt targeted strategies focused on higher volume to stay competitive. In this section, we present a comprehensive tool kit designed to empower emerging LIB OEMs in securing reasonable-demand offtake and to strengthen their market position in the face of fierce competition.

Focus on customized mobility applications

E-buses and e-trucks need custom LIBs because of varying factors like chassis length, payload capacity, desired range per charge, and operating conditions. Additionally, the demand by service providers for maintenance and safety checks of e-buses and e-trucks requires highly localized after-sales services. Legacy LIB OEMs do not focus on catering to the requirements of these end-use applications, as they prioritize mass production of standardized LIBs. This creates a compelling market opportunity for emerging LIB OEMs to meet the growing demand for tailored solutions that address the specific needs of the e-bus and e-truck segment. The regionalized presence of emerging LIB OEMs allows them to provide highly localized after-sales service, giving them a distinct advantage.

Focus on niche end-use applications

Niche applications such as e-ferries, e-locomotives, drones, and golf carts are witnessing an increasing demand in the SEA region, and local EV manufacturers are venturing into this space. Some examples include Penguin International in Singapore, Visedo and Ship and Ocean Industries R&D Center (SOIC) in Taiwan, and Energy Absolute’s partnership with Amita International in Thailand.

Notably, e-ferries are gaining traction as a viable use case, especially in countries like Thailand, the Philippines, and Indonesia, where ferries serve as a pivotal mode of transportation. This segment poses an interesting market opportunity, as established LIB OEMs are less inclined to cater to it due to the relatively low volume of demand and the larger battery-size requirements (800 kWh for e-ferries, 2,400 kWh for e-locomotives). This scenario opens the door for LIB OEMs to seize another opportunity by focusing on these niche applications.

Leverage non-price differentiators for competitive market advantages

Emerging LIB OEMs lack economies of scale and therefore face a challenge in their price competition with legacy LIB OEMs. However, these new entrants can strategically leverage other non-price differentiators to gain a competitive edge. Some of these differentiators include technological innovation tailored for niche applications, customized LIBs to meet specific customer requirements, hyperlocalized customer service, technical assistance, after-sales support, and bundling LIBs with charging infrastructure.

Identify partnerships to create cost & revenue synergies

Strategic partnerships for cost and revenue synergies are important. These partnerships not only provide a stable demand base, ensuring revenue synergies, but also grant access to cost-saving advantages, including affordable land, plants and machinery, raw materials, and other valuable resources. By strategically aligning with battery swapping, retrofitting, and ESS players, emerging LIB OEMs can secure captive demand, expand their reach, and drive innovation. A noteworthy example is the collaboration between Banpu NEXT and Durapower, which demonstrates the value of forging alliances with energy utilities. Additionally, direct alliances with automotive OEMs, as exemplified by Northvolt’s alliance with Volvo, offer an effective approach to securing captive demand and driving market penetration.

Lobby for local projects

Governments in SEA countries are setting ambitious goals for EV transitioning, which has created increased demand for locally manufactured and sourced components, including LIBs. By establishing themselves as key players in the local market, emerging LIB OEMs can position themselves favorably to secure tenders for supplying EVs. This approach aligns with the regionalization and local content regulations aimed at boosting the domestic EV industry and reducing dependence on imports.

Invest in sales, marketing & B2B

Emerging LIB OEMs should invest in robust sales and marketing initiatives while adopting a commission-based business-to-business (B2B) sales model. Investing in targeted marketing campaigns, digital outreach, industry events, and partnerships can help create a compelling brand image and generate leads. A commission-based B2B sales model incentivizes sales representatives and channel partners based on the sales volume generated, aligning their interests with the success of the business. By prioritizing sales and marketing efforts, emerging LIB OEMs can effectively showcase their product offerings, build brand awareness, and establish a strong market presence.

Strike a balance between technical R&D partnerships & in-house R&D capabilities

New LIB OEMs such as RECHARGE, VinES, and Amita have R&D partnerships with technical companies in other regions; in order to stay competitive, they must adopt a demand-based approach to R&D guided by shifts in technology and market requirements. However, developing an agile in-house R&D capability can be challenging and costly, especially considering the risk of investing in unproven technologies.

Instead, collaborating with external partners (e.g., research institutions, universities, or industry experts) is a more effective strategy for emerging LIB OEMs. By leveraging the expertise and resources of these external partners, LIB OEMs can access cutting-edge research, innovative technologies, and valuable insights without the burden of significant up-front investment.

Maintaining robust in-house capabilities is also important, as this allows LIB OEMs to retain control over critical aspects of their technology, maintain intellectual property rights, and build internal expertise. By striking the right balance between external collaborations and internal R&D efforts, emerging LIB OEMs can maximize their innovation potential and adapt to evolving market needs.

Conclusion

STAYING INFORMED & ADAPTABLE

The LIB market in SEA holds tremendous growth potential as the region continues its transition toward decarbonizing its transport sector and regionalizing its battery supply. Advancements in technology, changing regulations, and shifting customer preferences have led to a rapidly evolving LIB industry.

LIB OEMs should consider the following:

-

Seize opportunities presented by localization, technology partnerships, volume demand, and focused marketing efforts.

-

Monitor market trends, technological innovations, regulatory developments, customer demands, and competitive landscapes.

-

Anticipate and respond to market changes to establish long-term success.

-

Keep a vigilant eye on market dynamics.

With the right strategies, emerging LIB OEMs can successfully navigate the challenges, secure their position, and contribute to the region’s sustainable future.